PadSplit Members save an average of $420 a month living in a PadSplit — and sometimes they save even more than that! A savings account is an essential part of a solid financial plan. Most experts recommend having at least three to six months’ worth of living expenses in an emergency fund. After that, you can start saving for big expenses like a vacation or new computer.

An emergency fund is money that’s set aside for when life sends unexpected events your way. These events could include losing your job, getting sick, or needing to buy a new car. An emergency fund provides financial security in case something unexpected happens.

Whether you’re looking to build your emergency fund or save for a big purchase, getting started is often the hardest part. Be sure to include growing your savings in your monthly budget and to pay your savings account like any other bill.

Before we break down the types of savings accounts and how they work, it’s important to understand some common banking terms.

Here are the common terms you’ll see when reviewing different savings account options.

Common Savings Account Terms

Interest Rate

Typically, the interest rate is how much money you pay a lender, like a bank or credit card, to use their money. When it comes to savings accounts, the interest rate is how much money the bank pays you to keep your money on deposit. The interest rate for savings accounts is determined by the bank you open the account with.

Here’s an example of a deposit savings account that compounds annually. You deposit $1,000 into a savings account that has a 1% interest rate. You don’t add or withdraw any money throughout the year. The bank pays you interest on the balance of your savings account, the annual percentage yield (APY). After one year, the bank would pay you $10 for keeping your money with them.

FDIC Insurance or Protection

The Federal Deposit Insurance Corporation (FDIC) is an independent governmental agency. If your bank or credit union has FDIC insurance, the FDIC protects your deposits if the bank or credit union fails. It protects funds up to $250,000. Here’s how it works. Let’s say you have a certificate of deposit (CD) account with a balance of $500 and $15 in accrued interest. Your banking institution fails or closes. The FDIC will pay you the initial balance plus the accrued interest, your total CD balance of $515.

Always choose a bank or credit union that has FDIC insurance.

APY

The annual percentage yield (APY) refers to the amount of money you earn on your account during one year. The higher the APY on your account, the faster your money grows. APY varies from bank to bank. Talk to your bank to learn how they calculate APY so you can be sure you’re getting the best value.

Now that we’re clear on these common savings account terms, let’s look at three types of savings accounts and how they’re used.

3 Types of Savings Accounts

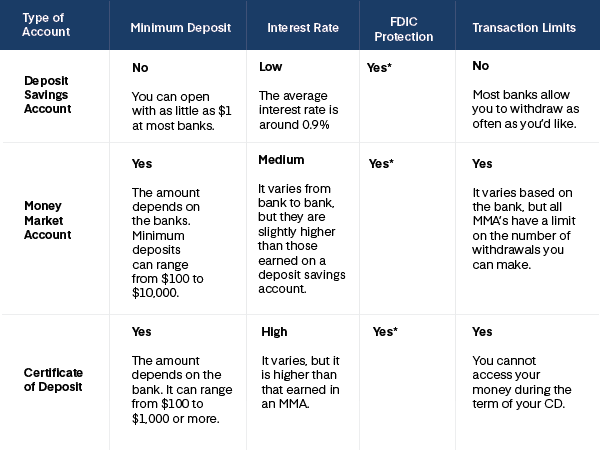

Deposit Savings Account

This is what most people think of when they hear the phrase “savings account.” For that reason, some banks and credit unions may refer to it as a regular or traditional savings account. These types of savings accounts typically pay a small interest rate but give you unlimited access to your money. They’re a safe option if you’re just getting started on building your savings.

Money Market Account

Money market accounts (MMA) share many of the same characteristics of deposit savings accounts. However, there are key differences. Most banks require a minimum deposit to open an MMA. The minimum deposit can range from $100 to $10,000. There are also limits on the number of withdrawals you can make from an MMA. The benefit, though, is MMA’s typically have higher interest rates than deposit savings accounts. That means you earn more money by depositing your money into an MMA. MMA’s are a good idea if you can meet the minimum deposit amount and don’t anticipate needing to make regular withdrawals.

Certificate of Deposit

A certificate of deposit (CD) is a type of savings account that has a fixed interest rate and a fixed date of withdrawal (maturity date). They’re often considered a type of low-risk investment. A CD holds your money for a specified period of time. Your money isn’t accessible during that time. As a result, they offer higher interest rates than deposit savings accounts. A CD term can range from one month to several years. The longer the term, the more interest you earn. The minimum deposit requirement varies from bank to bank. Some banks offer CDs for as low as $100. Others require a minimum of $1,000. CD’s are a good choice if you already have your emergency fund built up.

Conclusion: What if you want to build an emergency fund for a new savings account but aren’t sure how to cut down expenses? Cutting your living costs by moving into a PadSplit is a great first step. See how much you could save living in a PadSplit compared to your current rent. Remember, your PadSplit weekly dues cover everything you need — your private furnished room, all utilities, wifi, and free perks like telemedicine. That makes it even easier to start saving.

Have some savings but unsure what to do with them? Schedule an appointment with a financial advisor at your bank. They’ll review your current finances and savings goals. Then, help you figure out the best path for reaching them.